-- Net Revenues Increased Despite COVID-19 Pandemic-Related Challenges --

-- Improved Overall Operating Results and Net Income vs. Net Loss in 2019 --

Torrance CA, May 4, 2021- Emmaus Life Sciences, Inc. (OTC: EMMA), a commercial-stage biopharmaceutical company and leader in the treatment of sickle cell disease, announced today its financial results for the year ended December 31, 2020 as reported in its Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”).

Financial Results for the Year Ended December 31, 2020

Net revenues for 2020 were $23.2 million compared to $22.8 million in 2019, an increase of 2%. While there was a decrease in industry-wide prescriptions due to the COVID-19 pandemic and other related challenges in 2020, the company’s increase in net revenues was primarily attributable to the on-going rollout and market acceptance of Endari®. Emmaus believes it is well-positioned for continued growth as it expands the commercialization of Endari® in the U.S. and implements its early access programs and eventually commences marketing outside the U.S.

Operating expenses decreased by $5.2 million in 2020 to $21.0 million compared to $26.2 million in 2019. General and administrative expenses decreased by $3.3 million in 2020 to $13.7 million compared to $17.0 million in 2019. Of the $17.0 million in general and administrative expenses in 2019, $2.4 million was attributable to one-time, non-recurring expenses in connection with the merger transaction completed in July 2019. The $2.1 million decrease in selling expenses to $4.9 million in 2020 compared to $7.0 million in 2019 was due to a decrease in contract sales force fees for Endari® partially offset by an increase related to the company’s in-house sales team compensation. Emmaus has relied on its in-house commercial team for marketing and sales of Endari® in the U.S. since January 2020. The $0.2 million increase in research and development expenses to $2.4 million in 2020 compared to $2.2 million in 2019 was attributable to the Pilot/Phase 1 study of the company’s prescription grade L-glutamine oral powder to treat diverticulosis.

Operating loss in 2020 was $32,000 compared to $4.5 million in 2019. This major reduction in operating loss to nearly break-even was attributable to the decrease in operating expenses and increase in net revenues in 2020 as noted above.

Net income was $1.1 million in 2020 compared to a net loss of $54.8 million in 2019. This significant improvement in net income was primarily attributable to a $21.6 million decrease in interest expense in 2020, a $7.7 million gain on investment in marketable securities in 2020 compared to a loss of $21.9 million on investment in marketable securities in 2019 and a $2.1 million increase in interest and other income.

Cash flow used in operating activities improved to $2.5 million from $4.5 million in 2019. The company realized total net cash flow (including investing and financing activities) of $0.7 million in 2020 compared to a negative $2.1 million in 2019.

“We are pleased that the increase in our 2020 net revenues was achieved despite the industry-wide challenges posed by the COVID-19 pandemic and the FDA’s approval of two new sickle cell disease drugs in November 2019. In addition to the increase in net revenues, we showed improvement in operating results as both our operating loss and cash used in operating activities declined significantly in 2020,” said Dr. Yutaka Niihara, M.D., M.P.H., Chairman and Chief Executive Officer. “We also made considerable progress in 2020 in positioning our company for future Endari sales growth in the U.S. and outside the U.S. and advanced the development of our diverticulosis product candidate.”

Business and Other Company Updates

Direct Sales Force - Effective January 1, 2020, Emmaus switched from the use of a contract sales organization to its own direct sales force. The company currently has 23 employees in sales and marketing and continues to expand its sales and marketing capabilities.

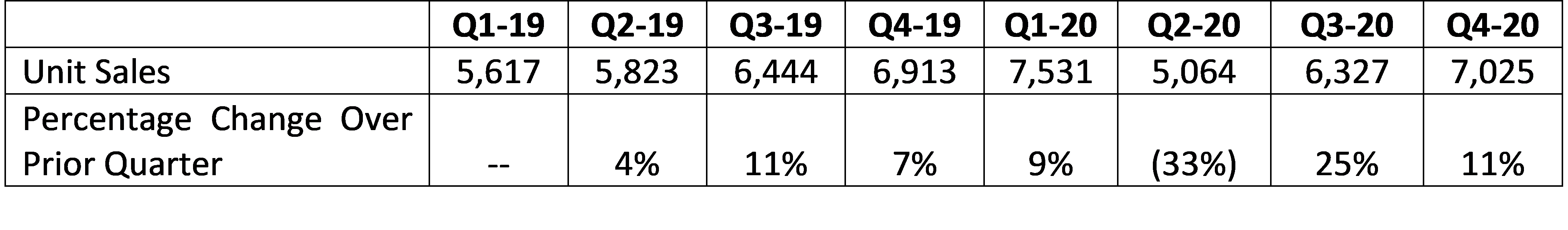

Increase in Sales Volume – Emmaus sold 25,947 boxes of Endari®, referred to as “Unit Sales,” in 2020 compared to 24,797 boxes in 2019, an increase of 5%.

The following table summarizes quarterly Unit Sales for 2020 and 2019:

Diverticulosis Study - The company’s Pilot/Phase 1 study of the same prescription grade L-glutamine oral powder used in Endari® in treating diverticulosis commenced in April 2019 and is ongoing. The COVID-19 pandemic has slowed the progress of clinical trials in the pharmaceutical industry, in general, and patient enrollment at one of the three sites of the company’s trial was suspended temporarily. Patient enrollment was completed, however, and Emmaus is confident the study will ultimately evaluate the change in the number and size of colonic diverticula and assess safety in patients with diverticulosis. Limited interim study results were encouraging, suggesting that Endari® may be effective in slowing and reversing the progression of diverticulosis. Emmaus expects to announce further results in the fourth quarter of 2021.

COVID-19 Impact – While the COVID-19 pandemic created challenges in 2020, Emmaus is encouraged that patient compliance and adherence as well as health monitoring overall held up well, which may bode well for improved patient adherence as the nation’s COVID-19 vaccine rollout accelerates and the pandemic subsides. However, ongoing stay-at-home orders and business lockdowns may adversely affect the company’s near-term revenues, results of operations and financial condition, and management will continue to monitor COVID-19 developments and take necessary actions to minimize any impact on the company’s business.

Manufacturing - The COVID-19 pandemic has not interrupted the company’s supply chain and Emmaus has ample inventory of Endari® and prescription grade L-glutamine (“PGLG”) to meet current and projected patient needs and support ongoing clinical trials. Progress continues at the manufacturing facility in Ube, Japan purchased by a 40% owned investee of Emmaus in December of 2019. To meet the long-term potential demand for PGLG, Emmaus, its partners and contractors are in the process of obtaining regulatory approvals and recertifications of the facility. The company currently anticipates that test production will commence later this year with regulatory approval expected in 2022.

Middle East and North Africa (“MENA”) Region - Emmaus continues to make progress in developing markets for Endari® in the MENA region. On June 29, 2020 Emmaus announced receipt of Endari® marketing authorization from the Israeli Ministry of Health and on July 23, 2020 announced the opening of its Dubai office to support its activities in the region. In addition, on November 10, 2020 the company announced its submission of a temporary license application in Bahrain for Endari®. These developments are in pursuit of the company’s efforts to reach the estimated 100,000 potentially treatable sickle cell disease patients in the MENA region.

Trading and Quotation of the Company’s Common Stock - On July 30, 2020, Emmaus was notified by the OTC Markets Group, Inc. that its common stock would no longer be eligible for quotation on the OTCQB tier as of the open of the market on August 3, 2020 due to the delays in filing with the SEC the company’s Annual Report on Form 10-K for 2019 and Quarterly Reports on Form 10-Q for the quarters ended March 31 and June 30, 2020. The company filed its 2019 Form 10-K on January 25, 2021 and anticipates that it will file in the coming weeks its March 31, June 30, and September 30, 2020 Quarterly Reports and will then be current in its SEC filings. Once it is current in its SEC filings, Emmaus intends to apply to the OTC Markets Group for quotation of its common stock on the OTCQB or OTCQX tier. In the meantime, quotes will continue to be available on the OTC Pink tier.

Endari® Label Change - On October 27, 2020, Emmaus announced that the FDA had approved an updated label for Endari® to better inform healthcare professionals and their sickle cell disease patients. The updated label states that the clinical benefits of Endari® were observed irrespective of hydroxyurea use, thereby supporting the use of Endari® as a monotherapy or in combination with hydroxyurea as important treatment options for sickle cell disease patients.

Endari® Support Program – On December 8, 2020, Emmaus announced the launch of the Endari® Support Program to provide eligible patients access to Endari® at minimal or no cost. This program is in addition to the company’s commercial co-pay assistance program. For more information, please see www.EndariRx.com/ESP.

Michigan Relaxes Prior Authorization Criteria for Endari® - In December 2020, the Michigan Department of Health and Human Services (“MDHHS”) notified Emmaus that, effective January 1, 2021, the following changes will be made regarding the initial authorization of Endari® thereby allowing it to be prescribed to more of Michigan’s sickle cell disease patients, more quickly, than under the prior authorization criteria: (i) the former requirement of a history of hydroxyurea use and adherence or intolerance/contraindication to hydroxyurea will be eliminated from the Endari® initial authorization documentation requirements and (ii) “patient/family refusal” will be added to the existing justifications of intolerance or contraindication to the use of hydroxyurea. With this recent revision, MDHHS joins many other state health and human services agencies in eliminating the prior use of hydroxyurea as a requirement for the initial authorization of Endari® for the treatment of sickle cell disease.

Preclinical Development of IRAK4 Inhibitor as Potential Anti-Cancer Drug – On March 2, 2021, Emmaus announced that it had entered into an agreement with Kainos Medicine, Inc. (“Kainos”), based in South Korea, to lead the clinical development of Kainos’ patented IRAK4 inhibitor (KM10544) as an anti-cancer drug. The KM10544 inhibitor has a potential role in treating malignancies such as Waldenstrom macroglobulinemia with MYD88 (myeloid differentiation factor 88) mutation where treatment options are currently very limited.

Convertible Promissory Note Financing – In March 2021, Emmaus successfully raised $14.5 million through a private offering of convertible promissory notes. Part of the proceeds from that financing were used to prepay the company’s senior secured 10% convertible debentures that had a $7.2 million principal balance as of December 31, 2020. In addition to eliminating the monthly principal amortization payments and high interest payments, the prepayment eliminated the company’s only senior secured debt thereby providing for future senior secured debt financing capacity, if needed.

2020 Annual Stockholders Meeting

The company intends to hold its next Annual Stockholders Meeting in July 2021 for the election of directors, to vote on certain other matters and to review 2020 operating results.

About Emmaus Life Sciences

Emmaus Life Sciences, Inc. is a commercial-stage biopharmaceutical company engaged in the discovery, development, marketing and sale of innovative treatments and therapies, including those in the rare and orphan disease categories. For more information, please visit www.emmausmedical.com.

About Endari® (prescription grade L-glutamine oral powder)

Indication (U.S.) - Endari® is indicated to reduce the acute complications of sickle cell disease in adult and pediatric patients five years of age and older.

Important Safety Information

The most common adverse reactions (incidence >10 percent) in clinical studies were constipation, nausea, headache, abdominal pain, cough, pain in extremities, back pain, and chest pain.

Adverse reactions leading to treatment discontinuation included one case each of hypersplenism, abdominal pain, dyspepsia, burning sensation, and hot flash.

The safety and efficacy of Endari® in pediatric patients with sickle cell disease younger than five years of age has not been established.

For more information, please see full Prescribing Information of Endari® at: www.EndariRx.com/PI.

About Sickle Cell Disease

Sickle cell disease is an inherited blood disorder characterized by the production of an altered form of hemoglobin which polymerizes and becomes fibrous, causing red blood cells to become rigid and change form so that they appear sickle shaped instead of soft and rounded. Patients with sickle cell disease suffer from debilitating episodes of sickle cell crises, which occur when the rigid, adhesive and inflexible red blood cells occlude blood vessels. Sickle cell crises cause excruciating pain as a result of insufficient oxygen being delivered to tissue, referred to as tissue ischemia, and inflammation. These events may lead to organ damage, stroke, pulmonary complications, skin ulceration, infection and a variety of other adverse outcomes. Sickle cell disease is a significant unmet medical need, affecting approximately one hundred thousand patients in the U.S. and millions worldwide, the majority of which are of African descent. An estimated 1-in-365 African American children are born with sickle cell disease.

Forward-looking Statements

This press release contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended, including statements regarding the Company’s business and operations and future financial results. These forward-looking statements are subject to numerous assumptions, risks and uncertainties which change over time, including uncertainties related to Emmaus’ working capital and ability to obtain needed financing and other risk factors disclosed in the Company’s 2020 Annual Report on Form 10-K and other reports filed with the SEC, and actual results may differ materially. Such forward-looking statements speak only as of the date they are made, and Emmaus assumes no duty to update them, except as may be required by law.

Company Contact:

Emmaus Life Sciences, Inc.

Mark Diamond

Chief Investment Officer

(310) 214-0065

mdiamond@emmauslifesciences.com

(Selected Condensed Consolidated Financial Data Follows)

Emmaus Life Sciences, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(in thousands, except share and per share amounts)

| Year Ended December 31, | 2020 | 2019 |

| Revenues, Net | $23,167 | $22,752 |

| Cost of Goods Sold | 2,248 | 1,094 |

| Gross Profit | 20,919 | 21,658 |

| Operating Expenses | 20,951 | 26,170 |

| Loss from Operations | (32) | -4,512 |

| Total Other Income (Expense) | 751 | -50,166 |

| Net Income (Loss) | 1,100 | -54,842 |

| Comprehensive Income (Loss) | 2,316 | -54,852 |

| Earnings (Net Loss) per Common Share | $0.02 | ($1.30) |

| Weighted Average Common Shares Outstanding | 48,897,004 | 42,259,460 |

Emmaus Life Sciences, Inc.

Condensed Consolidated Balance Sheets

(in thousands)

| As of | 31-Dec-20 | 31-Dec-19 |

| Assets | ||

| Current Assets: | ||

| Cash and cash equivalents | $2,487 | $1,769 |

| Accounts receivable, net | 198 | 2,150 |

| Inventories, net | 7,087 | 7,971 |

| Investment in marketable securities | -- | 27,929 |

| Prepaid expenses and other current assets | 1,485 | 1,402 |

| Total Current Assets | 11,257 | 41,221 |

| Property and equipment, net | 120 | 151 |

| Equity method investment | 15,664 | 13,325 |

| Investment in convertible bond | 27,866 | -- |

| Other assets | 4,368 | 4,759 |

| Total Assets | $59,275 | $59,456 |

| Liabilities and Stockholders’ Equity (Deficit) | ||

| Current Liabilities: | ||

| Accounts payable and accrued expenses | $7,460 | $11,498 |

| Notes payable | 4,588 | 3,749 |

| Convertible debentures, net of discount | 5,480 | 7,015 |

| Convertible notes payable, net of discount | -- | 2,995 |

| Other current liabilities | 5,854 | 7,570 |

| Total Current Liabilities | 23,382 | 32,827 |

| Notes payable, less current portion | 222 | -- |

| Convertible notes payable | 3,150 | -- |

| Other long-term liabilities | 37,940 | 37,682 |

| Total Liabilities | 64,694 | 70,509 |

| Stockholders’ Equity (Deficit) | -5,419 | -11,053 |

| Total Liabilities & Stockholders’ Equity (Deficit) | $59,275 | $59,456 |